how to buy tax liens in maricopa county

To obtain the deed on your tax lien certificate you must follow a three step process. Are you interested in buying tax liens.

2022 Elections Battlegrounds To Watch Maricopa County Arizona Politico

Payment in full with Cash or Certified Funds.

. Interested parties must complete an Unsold Previously Offered Parcel Offer Form PDF and submit this form and payment in cash or guaranteed funds Cashiers Check or Money. Tax lien investing is the act of buying the delinquent tax lien on a property and earning profits as the property owner pays interest on the certificate or from the liquidation of the collateral. The first step is to send a 30 day demand letter that meets all of the statutory requirements.

In fact the rate of return on property tax liens investments. To obtain copies of Arizona Revised Statutes you may visit the Maricopa County Law Library at 101 W Jefferson St Phoenix AZ 1-602-506-3461 or check out ALIS. You can now map search browse tax liens in the Yavapai Coconino Apache.

That list will be online on the countys website and theyll also publish the list to the local newspapers. Download a list of tax liens available for purchase please be patient this may take a while. Maricopa County County AZ tax liens available in AZ.

Find Information On Any Maricopa County Property. Investing in tax liens in Maricopa County CA is one of the least publicized but safest ways to make money in real estate. Ad Need Property Records For Properties In Maricopa County.

Every one of those. Do you currently reside in Maricopa County. Register for 1 to See All Listsings Online.

Ad Tax Lien Certificates Yield Great Returns Possible Home Ownership. Find the best deals on the market in Maricopa County County AZ and buy a property up to 50 percent below market value. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset.

4 counties in Arizona have now released their property lists in preparation for the 2022 online tax lien sales. The Maricopa County Arizona Treasurers Office requires that buyers submit a list of the property tax lien certificates they intend to purchase along with a cashiers check money. In this video learn how to buy tax liens in Maricopa County and find out.

Upon receipt of a cashiers check or certified funds the Department of Revenue will immediately provide a Notice of Intent to Release State Tax. Acquire Valuable Properties Or Get 18-36 Interest. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset. Ad Buy HUD Homes and Save Up to 50. The county will make a tax delinquent properties for sale list.

Displaced In America Housing Loss In Maricopa County Arizona

Pay Your Bills Maricopa County Az

Maricopa County Assessor Interactive Map Government Affairs

New Supervisor Districts Ok D Maricopa Whole Coolidge Split News Pinalcentral Com

City Limits Maricopa County Az

Maricopa County Island What Is It Arizona Homes Horse Property

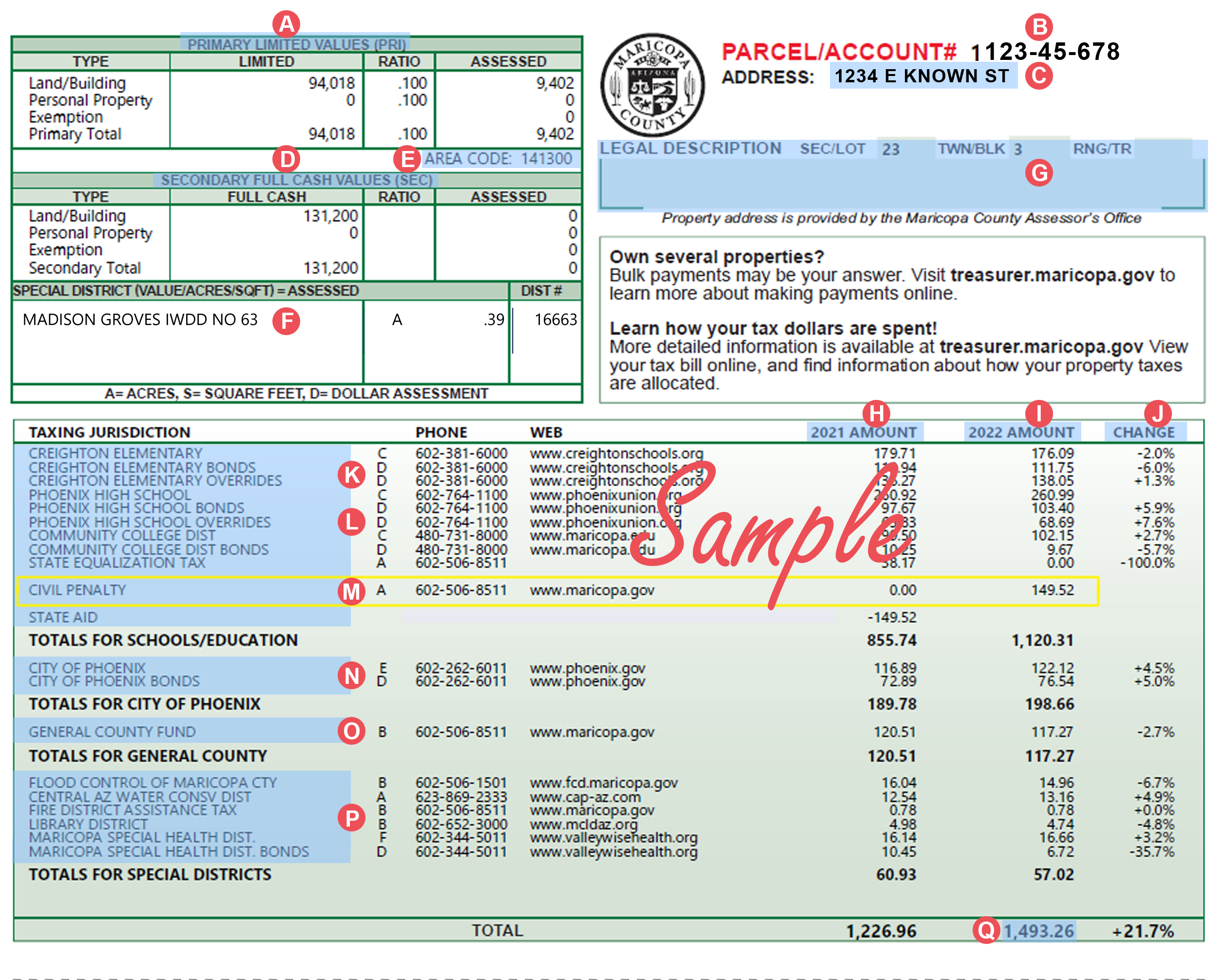

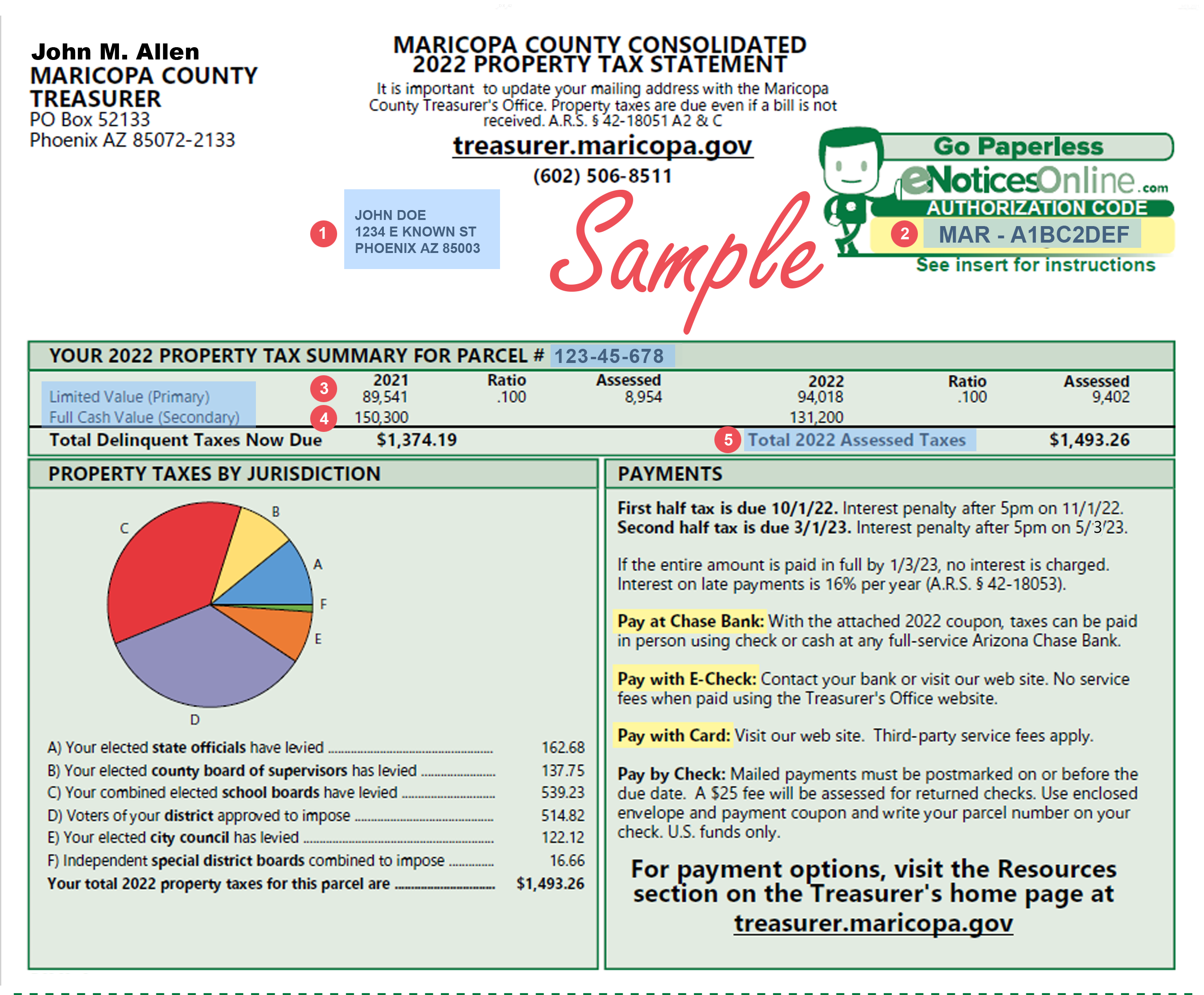

Property Taxes In Arizona Lexology

Maricopa County Assessor S Office

Maricopa County Approves 3b 2021 Budget Azbex

Pha Annual Plan 2021 2022 Housing Authority Of Maricopa County

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Auctions Leases Maricopa County Az

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More